Applicable Federal Regulations: 34 Cfr 668.22

This law requires that institutions determine the amount of federal financial aid (Title IV programs) that a student earned at the time of his or her withdrawal. The Title IV programs that are covered by this law include: Federal Direct Stafford Loans, Federal Direct PLUS Loans, and Federal Perkins Loans.

When a student withdraws during the payment period or period of enrollment, the amount of Title IV program assistance that the student earned to that point (Withdrawal Date) is determined by a specific federal formula. If the student received less assistance than the amount that was earned, the student may be able to receive those additional funds as a Post-Withdrawal disbursement. If the student received more assistance than the amount that was earned, the excess funds must be returned by the school and/or the student.

Earned and Non-Earned Aid

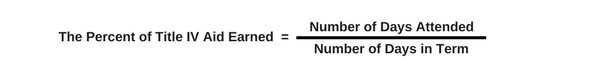

When a student withdraws and they are a financial aid recipient, the Seminary’s Financial Aid Office has to determine what percentage of their aid has to be returned to the Federal Government. This is done through a process called R2T4 (Return calculation). Federal Regulations state that a student begins earning Federal (Title IV) funds on his or her first day of attendance for the given period of enrollment. The earned aid is therefore calculated by dividing the number of days attended by the total number of days in the given term to determine the percent of aid earned.

In other words,

Based on the results of this calculation, the Financial Aid Office is required to notify the student of his or her eligibility, if any, for a Post-Withdrawal disbursement within 30 days of the date the student withdraws from the University. The amount of assistance that a student has earned and is therefore, eligible to keep, is determined on a pro rata basis. For example, if the student completed 30% of the payment period or period of enrollment, the student has earned 30% of the federal financial aid that he or she received or was scheduled to receive. This also means that the student did not earn 70% of the scheduled federal financial aid and this amount must be returned to the federal financial aid program. Once a student has completed more than 60% of the payment period or period of enrollment, he or she has earned all the federal financial aid received or scheduled to be received for that period.

Post-Withdrawal Disbursements of Federal Financial Aid

If the withdrawn student did not receive all of the funds that he or she earned, they may be eligible for a Post-withdrawal disbursement. If Post-withdrawal disbursement includes loan funds, the Seminary Financial Aid Office must get the student’s permission before it can disburse them. Students may choose to decline some or all of the loan funds so that they do not incur additional debt.

For students, all or a portion of the Post-Withdrawal disbursement of grant funds may be automatically used for any existing outstanding charges, including tuition, fees and housing charges. The will need the student’s permission to use the Post-Withdrawal grant disbursement for all other school charges. If the student does not give permission, they will be offered the funds. However, it may be in the student’s best interest to allow the school to keep the funds to reduce their debt at the school.

There are some Title IV funds that may have been scheduled for release but can no longer be disbursed on the student’s account because their withdrawal and other eligibility requirements have not been met.

Required Post-Withdrawal Returns

If the withdrawn student received more Title IV program funds than they earned, the Seminary’s Bursar’s Office must return this unearned excess amount to the appropriate aid program.

As required under regulation 34 CFR 668.22 and determined by the Return Calculation, unearned aid is returned in the following order as applicable:

- Federal Direct Stafford Loans

- Federal Perkins Loan

- Federal Grad PLUS Loan

- Union Grants, Scholarships or Fellowships

- Union Loan

Any unearned portion of Financial Aid that was disbursed to the student must be repaid to the Seminary. If the return of the unearned federal funds results in a debit to the student’s account, they will be responsible for the outstanding balance owed to the Seminary.

Post-Withdrawal Refund of Earned Aid

In the event that the withdrawn student is eligible for a refund, it is extremely important to keep their mailing address up to date so that the refund can be mailed. Students should also check their Union email account periodically for any updates, alerts, emails etc that may contain important information that could have an impact on registration should the student decide to return to the Seminary.

The Seminary is required by law to refund earned credit balances within 14 days from the date the earned aid was determined.

How Course Credits Can Affect Your Financial Aid Eligibility

You must enroll in at least 9 credits full-time status for your financial aid to disburse to your student account. Your financial aid may be adjusted if you do not enroll full-time. Enrollment for financial aid purposes is measured after the deadline to add classes each quarter. Students enrolled less than full-time as of the add deadline date will have their aid adjusted as described below. Enrollment changes after the will not result in financial aid adjustments unless:

- financial aid is awarded after the seventh week;

- you receive all W grade notations; or

- you withdraw from the seminary before the end of the term

Credit values for financial aid eligibility are as follows:

- Full-time: 9+ credits or more

- Part-time: 6 credits (students who are enrolled for a least half-time may retain eligibility for federal and institutional loans, but not institutional grants and scholarships)

- Less than half-time: 5 credits and fewer—you are generally not eligible for financial aid

You will be required to repay any financial aid you receive for semesters in which your aid is adjusted due to less than full-time enrollment. You may also be required to pay financial aid received if you leave or withdraw from all courses during a semester. Check with the Financial Aid Office (212) 280-1531 for more information.